To fee or not to fee: managing fee structures

A complex fee structure tied to a shareholding raised questions as to the deductibility of fees for income tax purposes.

Ultimately the Australian Tax Office (ATO) ruled that it was not a deductible expense, resulting in a large tax debt and a reduction in the return to stakeholders of the external administration.

Background

We were appointed voluntary administrators of a company in the financial services industry in 2013. At the time of appointment, the company had three classes of shareholders and was receiving commission fee and volume rebate income from financial products and services.

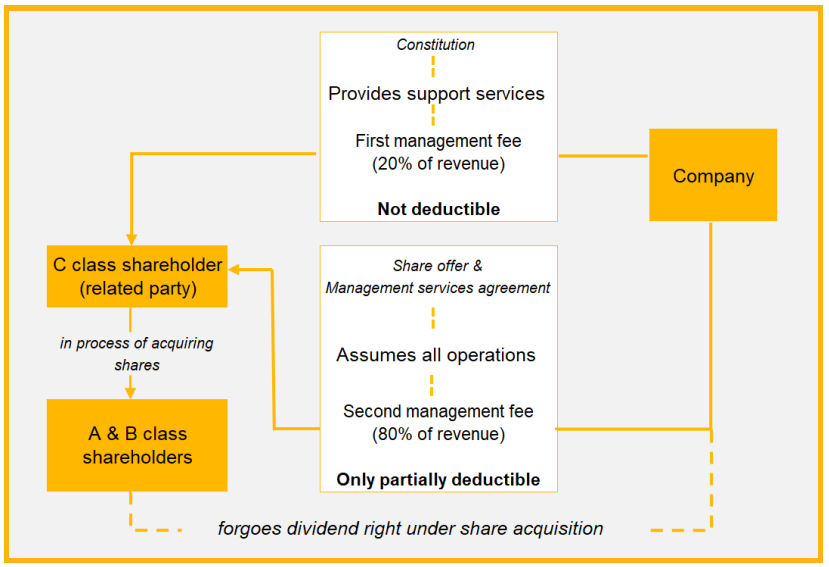

Its sole C class shareholder, also a related party entity, was paid a management fee for providing various support services to the company (the first management fee).

The management fee was calculated as a fixed 20% of the company’s revenue and was recognised as an entitlement to the C class shareholder in its constitution, as well as through a management services agreement. Other than the usual business expenses, the company also paid a marketing allowance to advisers who had met certain performance criteria and were awarded A and B class shares.

Under a restructure and share acquisition offer by the C class shareholder for al l A and B class shares, it became entitled to the balance of the company’s revenue (a further 80%) as a management fee (the second management fee).

At this time, the C class shareholder took over the company’s operations and became responsible for al l operational requirements and expenses. A new management services agreement was established. The company fully established. The company fully expensed income as a management fee and it had little to no income tax liability under this arrangement.

The issue

The management services agreement was, after review, formally terminated after our appointment, however the question remained as to whether the management fee would be considered an expense of the company (and therefore deductible for income tax purposes) prior to the termination of the agreement.

Given the circumstances and complex interaction of numerous agreements, including the presence of debt security, creditors, and shareholders, which gave rise to priority issues under the Corporations Act, a tax ruling was sought on the matter. The ATO was asked to consider whether the first management and/or the second management fee paid were deductible under Section 8-1 of the Income Tax Assessment Act 1997.

The ruling

The ATO found that the first management fee was not deductible and only a portion of the second management fee was deductible to the company. The key considerations by the ATO are summarised below:

- The entitlement to the first management fee was provided for in the constitution, the effect of which was that the C class shareholder was entitled to same, regardless of whether any actual services had been provided.

- Despite advice that the C class shareholder provided strategic and business advisory services, as well as support during the establishment period, there was no formal documentation detailing the nature of these services, nor did the constitution define or explain the purpose of the management fee.

- Subsequent reference to the first management fee in the share offer documents again associated the fixed fee entitlement to the shareholding, including in the event of liquidation.

- The first management fee was viewed as a payment not for services incurred in producing assessment income, but rather a payment to a shareholder (akin to a dividend).

- The second management fee was supported by a management services agreement, which listed the type of services to be provided, however the calculation of the fee payable did not consider or reflect the actual services performed. In particular, it was noted that the fee was, in part, made to compensate the C Class shareholder for the share acquisition offer.

- The offer provided for a reduction of the fee if the C class shareholder failed to complete the share purchase. The reduction suggested that the payment was not for services provided and the calculation of same was not reflective of actual services performed It was determined that a portion of the second management fee had been incurred for a non-incoming producing advantage and to that extent was not a fully allowable deduction.

The outcome

The ATO’s ruling resulted in a substantial income tax debt for the company. This ultimately reduced the pool of funds available for distribution to the company’s stakeholders.

Whilst the arrangements put in place by the company were unique and complex, it is important to keep in mind that an expense should not only be categorised as such based on its ‘name’, but on careful consideration of the basis and nature of the payment. It is also equally important to ensure that it is documented and can be substantiated in substance in the event it is challenged.

For other creditors who may rely on funds flowing by virtue of management services arrangements, it is imperative to understand the arrangements prior to entering into any commitments.

How can Cor Cordis assist?

If you require further information or would like a confidential discussion, please contact one of our partners at our office near you.