Director personal liability for GST

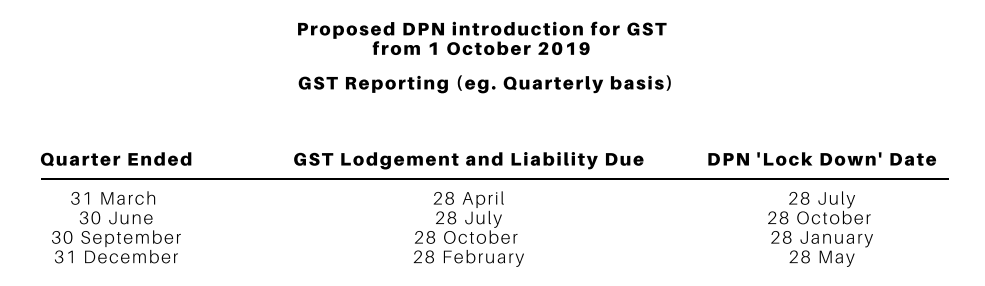

The Federal Government re-introduced legislation to parliament on 5 July 2019 which will provide for Director Penalty Notice (DPN) for Goods and Services Tax (GST) from 1 October 2019.

This would operate like the existing Pay As You Go (PAYG) and Superannuation Guarantee Charge (SGC) DPN regimes. Cor Cordis is monitoring the legislation closely and will advise its network if, and when the legislation receives royal assent (and becomes law).

This change is likely to have wide reaching implications as in our experience many companies will have much greater exposure to GST than PAYG or SGC.

How would it work?

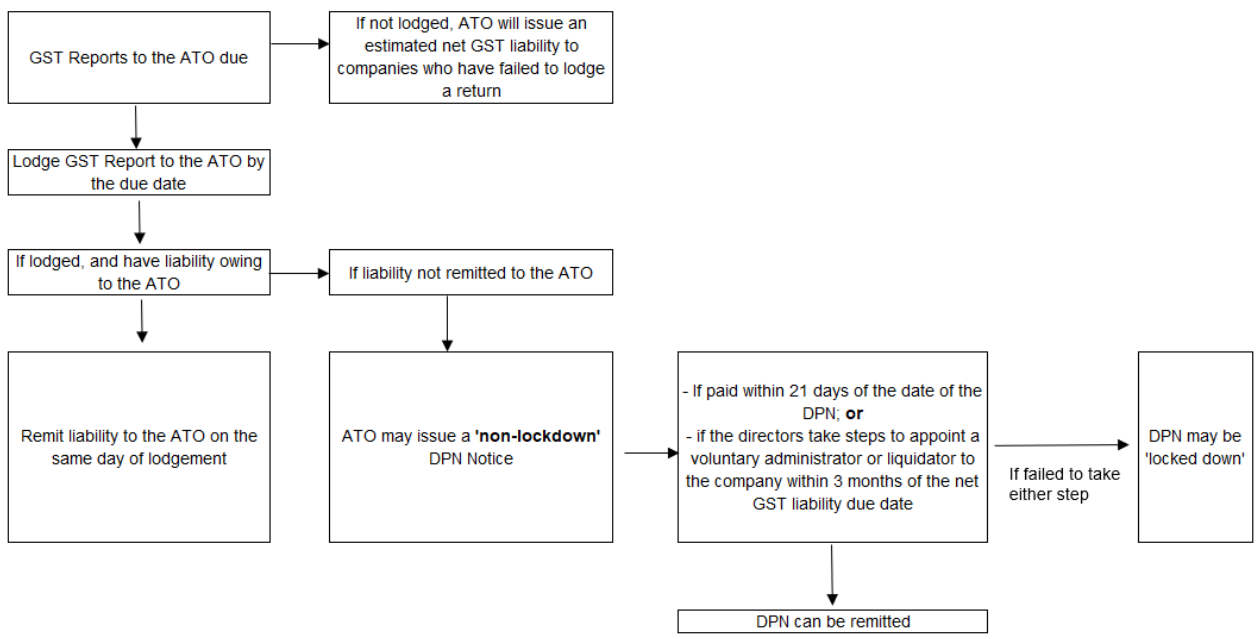

The legislation will impose an obligation on a director to ensure that any net GST liability is paid, or if it is not paid, to place the company into voluntary administration or liquidation.

DPNs will issued by the Australian Taxation Office (ATO) after the payment due date and recoverable from the director personally.

The ATO will also be able to issue estimated net GST liability assessments to companies who fail to lodge a return. The company is then required to pay the estimated net GST liability – with that amount deemed to be due on the GST lodgement due date.

DPNs can be remitted (cancelled) if:

- The company pays the net GST liability either before the DPN is issued, or within 21 days of the date of the DPN.

- The directors take steps to appoint a voluntary administrator or liquidator to the company within three (3) month of the net GST liability due date.

If either of these steps have not been taken within the specified time frame, the DPN may be ‘locked down’ and may not be remitted (cancelled).

Steps

Defences

The existing PAYG and SGC defences would apply to GST DPNs:

- Illness or other good reason, plus taking all reasonable steps; or

- The company adopted a reasonably arguable position and took reasonable care.

Other recent changes

On 1 April 2019, new legislation came into effect providing a more stringent reporting regime for SGC.

The timeframe for reporting a company’s outstanding SGC was reduced from the previous three-month period to the superannuation guarantee charge date, which is one (1) month and 28 days from the end of each financial year quarter.

The changes to the legislation now mean that a director cannot avoid personal liability for any outstanding SGC debt by appointing a voluntary administrator or liquidator to the company, where the SGC debt remains unpaid and unreported within one (1) month and 28 days from the end of each financial year quarter.

The DPN is therefore “locked down” and may not be remitted (cancelled).

How can Cor Cordis assist?

If you require further information or would like a confidential discussion, please contact one of our partners at our office near you.